APIs to Build Your Business

Start Building with Nupay’s Easy-to-Integrate APIs for onboarding, payments and lending !

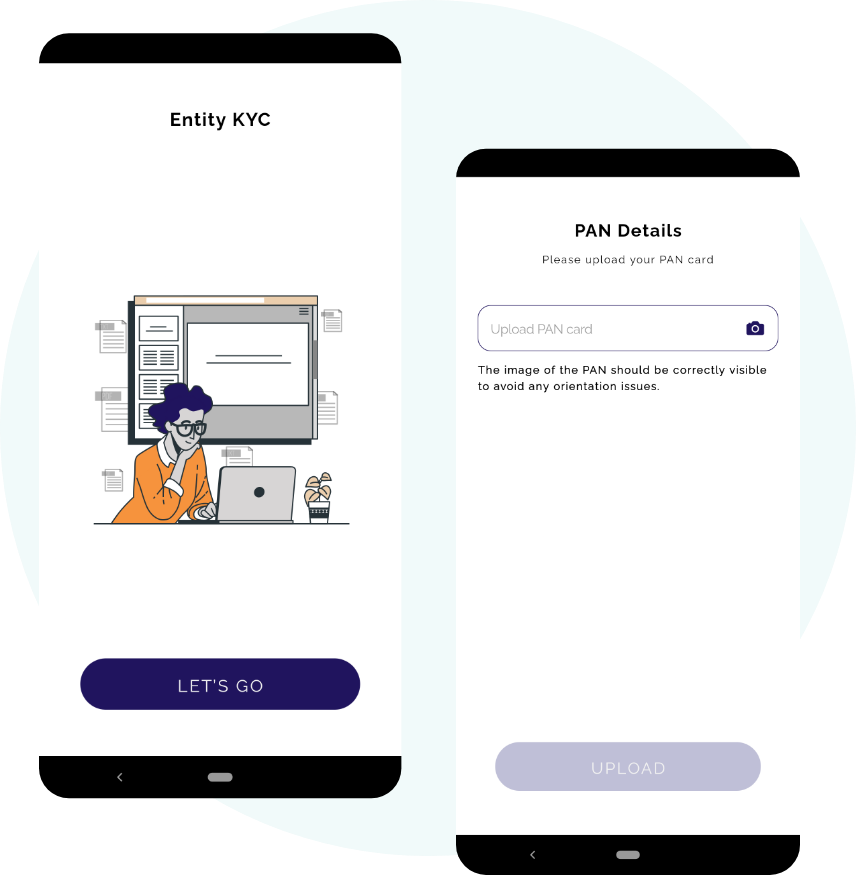

Onboard

APIs to Onboard Your Customers and Vendors

- Verify PAN, GST, Aadhaar and bank accounts real time

- Create digital user journeys by embedding KYC for verifying users, eSign documents and pre-filled onboarding data

Use cases – Pre-filled physical NACH and digital lending sourcing, beneficiary bank account validation for disbursements and payouts, vendor/suppliers onboarding, marketplace buyer and sellers onboarding and customer/borrowers verification

UPI

Pay to any UPI ID eliminating the need of bank account details

- Send UPI collect requests to customers or register for UPI AutoPay for direct debits

- Create links to collect money directly into Virtual Accounts

Use cases – B2B payment collections, consumer payments, QR code-based payments and collections for invoices raised, micro-payments, EMI collections for micro-finance institutions, collections for insurance premiums, investments and SIP

Collect

Create Virtual Accounts and Wallets for collecting payments

- Automate your reconciliation and maintain ledgers

- Accept RTGS, NEFT, IMPS and UPI payments from buyers

Use Cases – Buyer and seller payments, instant settlements, agent-based collections, invoice-based collections and real-time payee identification

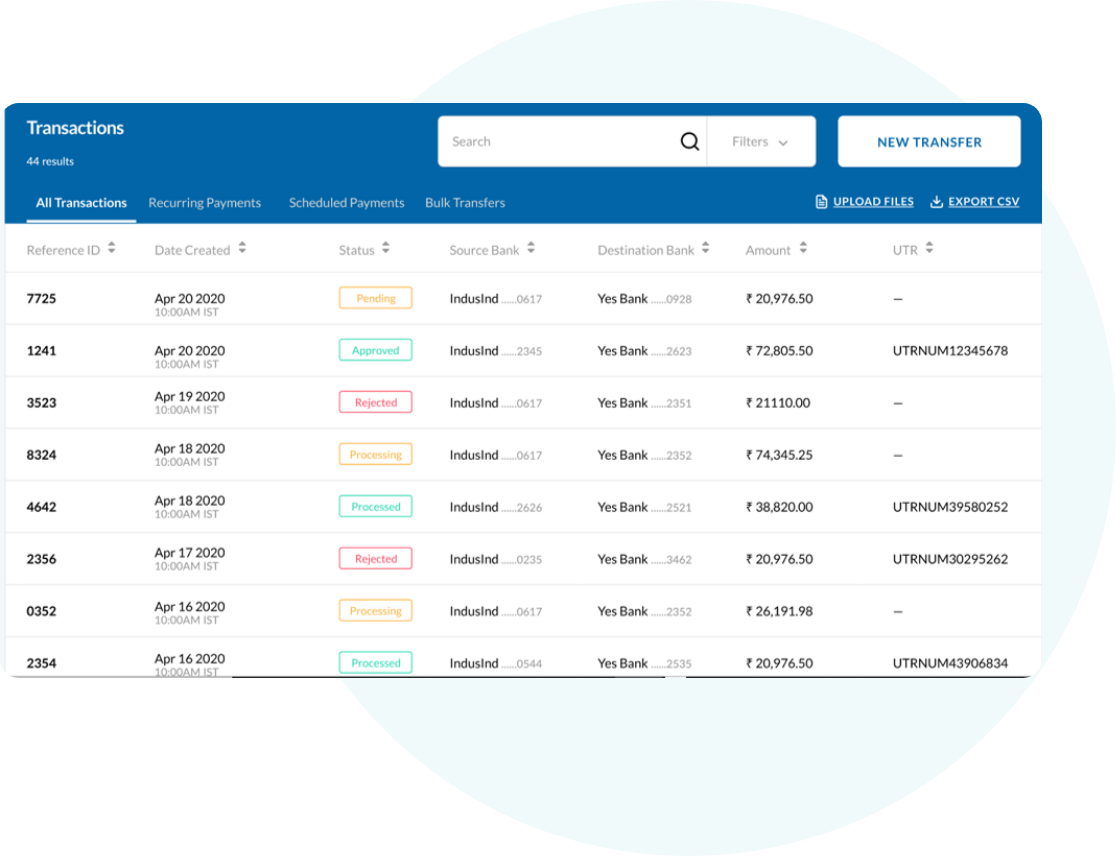

Payouts

RTGS, NEFT, IMPS and UPI Payouts to Any Bank

- Connect and transact from your existing bank accounts

- Bulk uploads and approval based single payouts

Use Cases – Vendor and expense payouts to beneficiaries, tax payments for enterprises, Bulk payouts and refunds for marketplaces and aggregators, agent commissions and incentive payments

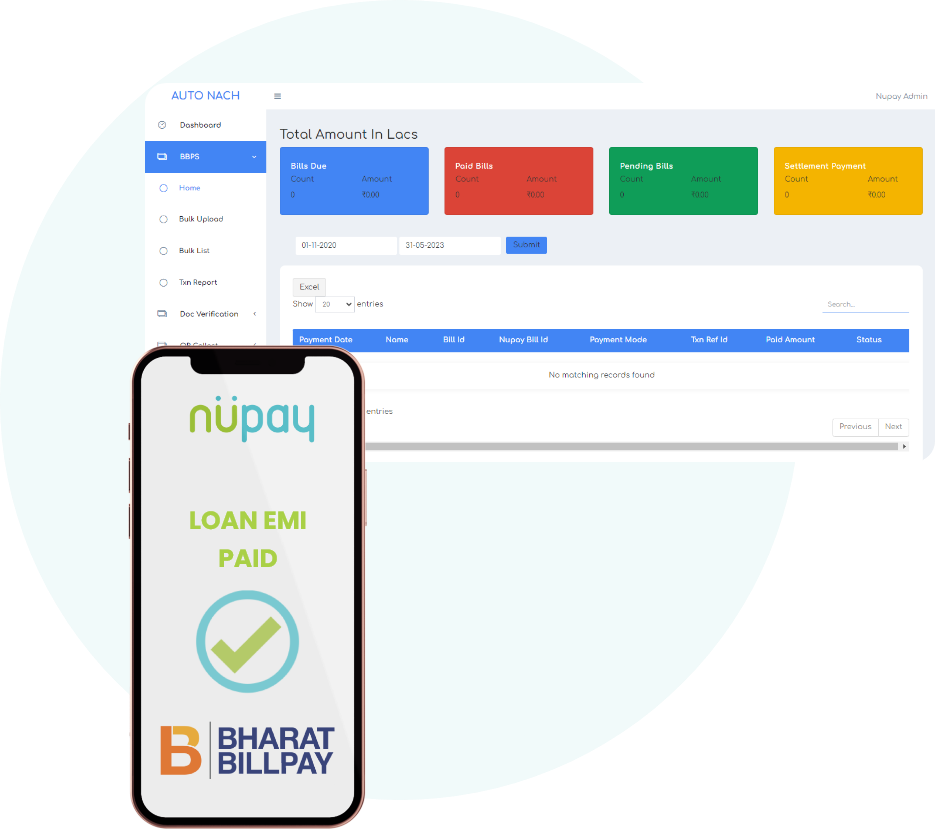

BBPS

Onboard as Biller on Bharat Bill Pay System and Start Accepting Payments

- Collect payments by listing on all payment apps, bank portals and offline merchants

- Zero integration effort – Get started by uploading data

Use Cases – EMI collections for NBFCs, utilities and education fees, recurring payments and subscriptions

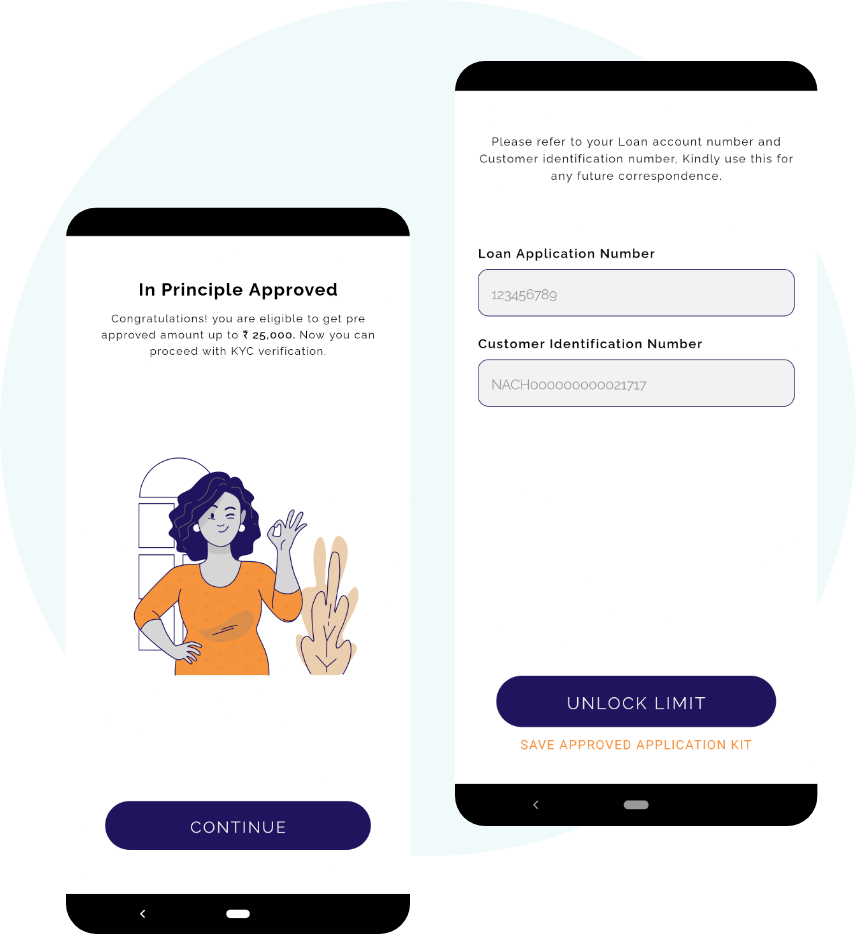

Loans

Get Access to Loan Products from Leading Banks and NBFCs

- Embed loan products in your app and web portal for your customers

- Earn revenue by monetising your customer base and distribution network

Use Cases – Neo banks, lending and insurance aggregators, agent networks, offline retail networks and online marketplaces