autoNACH – India’s leading recurring payments platform

Automate and Transform the way you collect recurring payments through a single integrated platform for registering NACH, e-Mandates, UPI Autopay, BBPS and more.

Streamline recurring payments Autogenerate e-mandates Optimize the Buying Experience

Product Features

Built for scale

Real time and scalable infrastructure for multiple use cases - NBFCs, Digital Lending, Insurance, Investments, Education, Utilities, OTT, Rentals and more

Increase success rates

Innovative with Inbuilt customer verifications, NPCI/Bank compliances, Image enhancements and end-to-end automation for higher success rates

APIs for all Payment modes

Register Physical Mandates, eMandate through Net Banking, Debit Card or Aadhaar, UPI Autopay and BBPS

Flexible

Choose relevant service, work with your own sponsor Bank and build your own interface or payment pages

Seamless User Experience

Integrate autoNACH in your own customer journeys, send automated links, configure approval workflows before sending to sponsor bank.

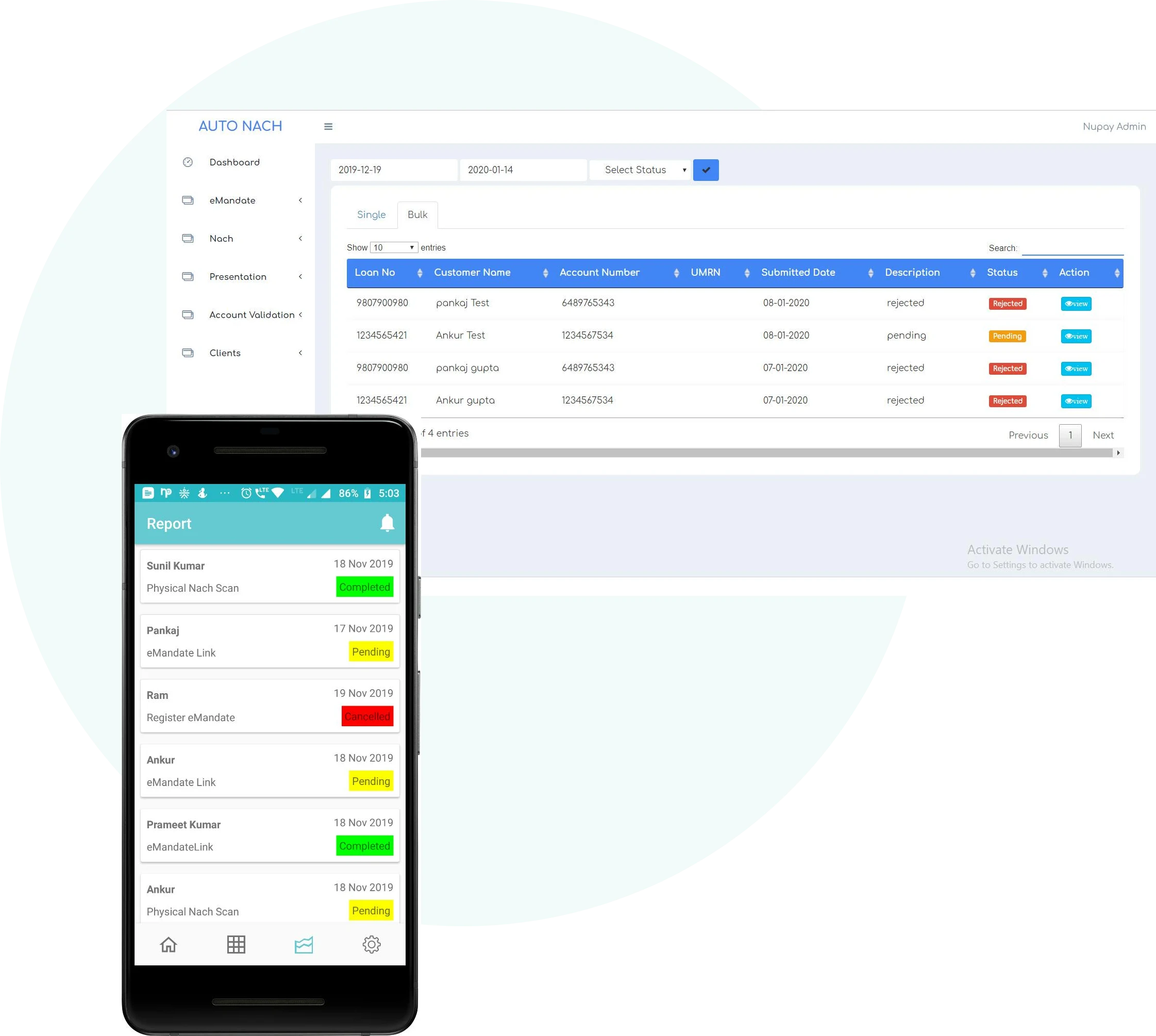

Complete Platform

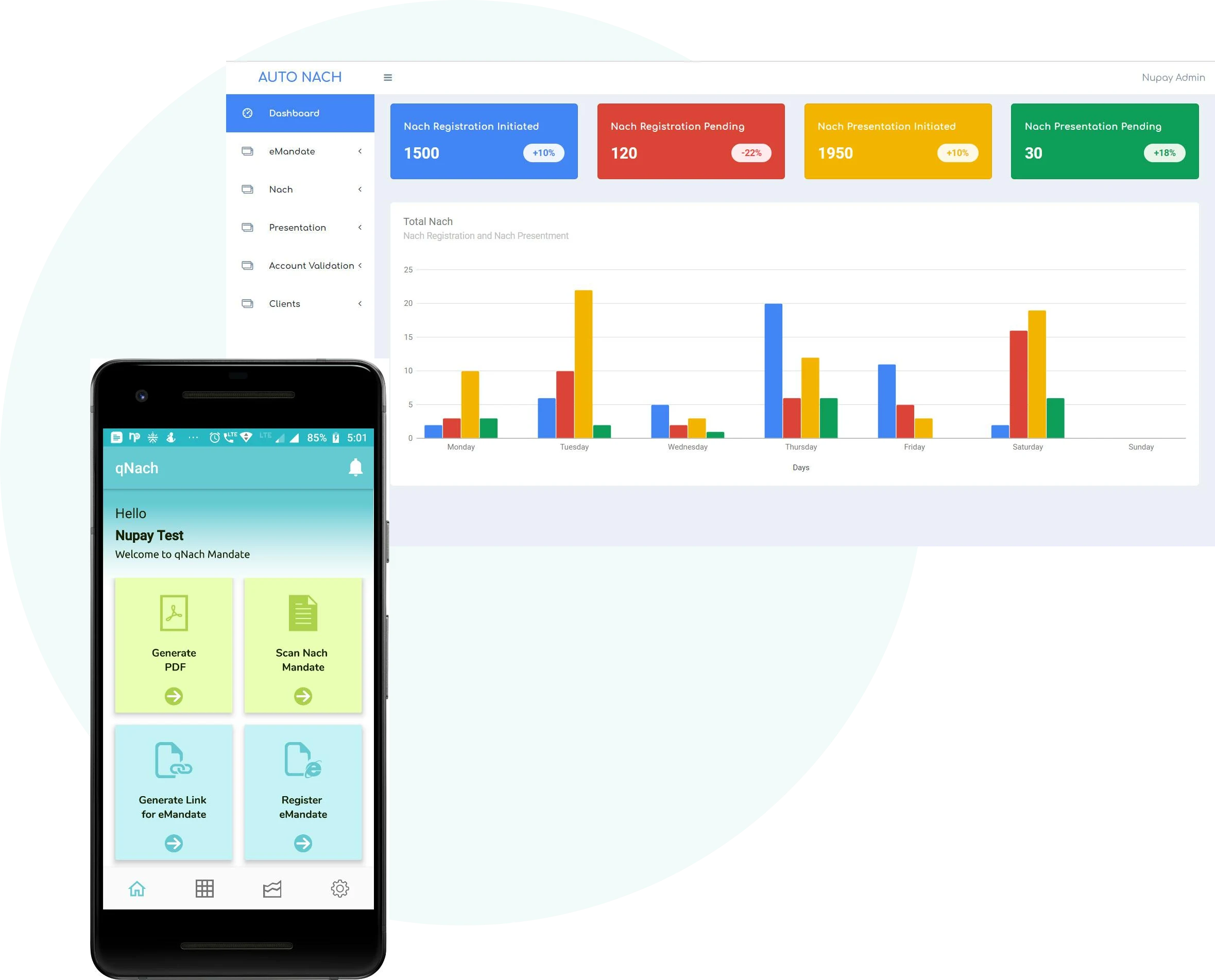

Access through APIs, Web and Mobile

- Easy to integrate APIs for your LOS, LMS and payments systems

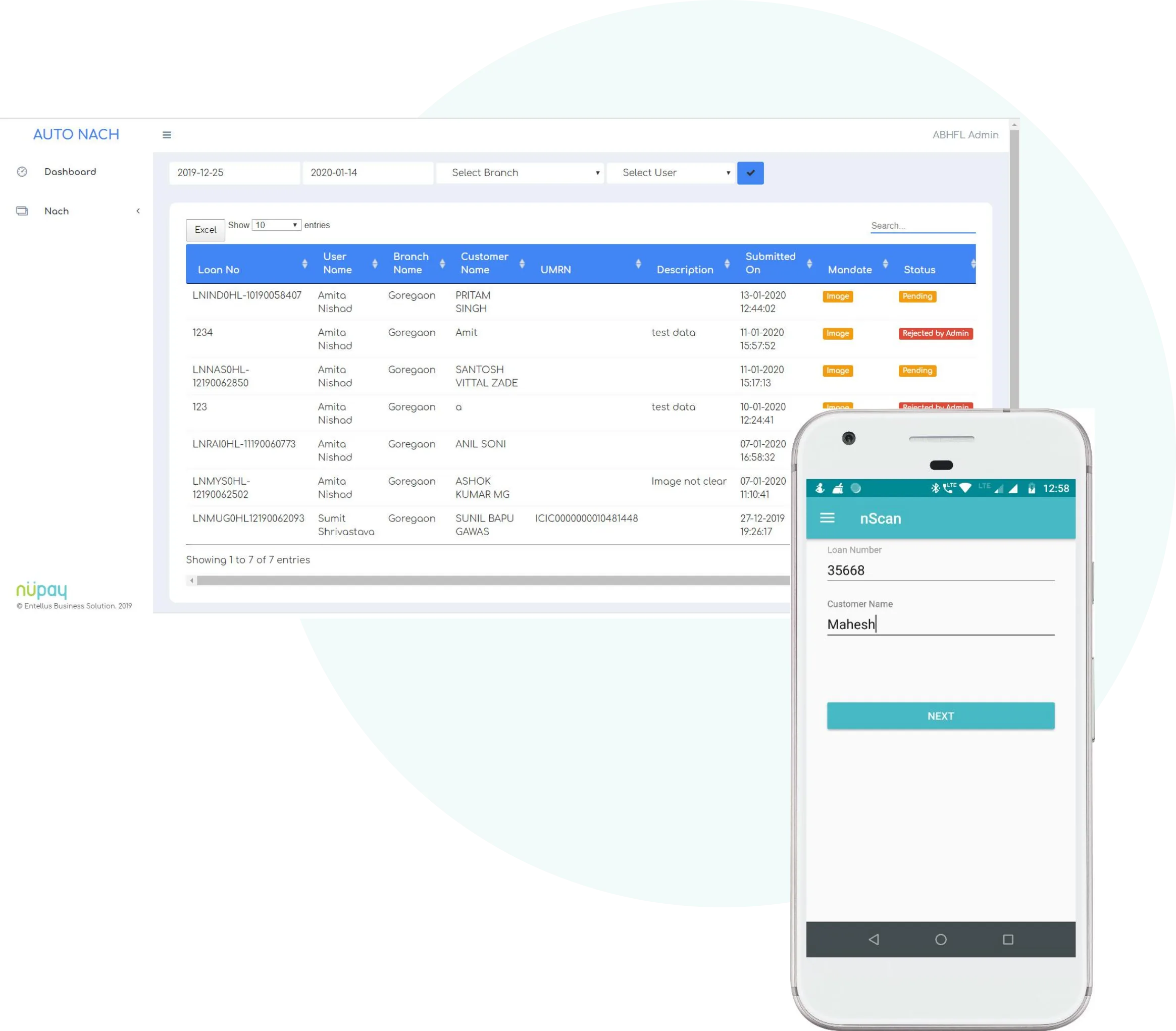

- Intelligent Dashboard for all transactions or bulk upload of presentation files

- Mobile app for agent-based collections and physical mandate scanning the source

- Generate customised eMandate links on the go with your brand name

Digital Lending Automation

Collections, Loan Disbursements and More

- All modes of recurring payments – Physical Mandates, eMandates, UPI AutoPay and BBPS

- Automate disbursements of loans from own bank account(s)

- ‘First in Industry’ QR Code based collections at the source

- Verify borrowers – Bank account, PAN and GST

Modernise Operations

Process Large Number of Transactions and Automate Reconciliations

- Configure workflows for mandate approvals

- Process millions of transactions without changing or creating presentation file formats

- Automated reconciliations with custom reporting and analytics

- Agent and customer level mapping for each transaction

Industries

NBFCs

Banks/Financial Services

Insurance

Investments

Utilities